For anyone looking to get certainty in achieving your financial goals

Value-Packed Book Covering 8 Essential Areas About Money Management

Allowing You to TAKE CONTROL of Your Own Financial Future

Step-by-step, from budgeting for life events, CPF optimisation, housing, everything from insurance to investment planning.

What is "Personal Finance Unlocked" all about?

"Personal Finance Unlocked" is one of the

most comprehensive guidebook on the topic of personal finance to help working adults and fresh graduates to get an winning edge in taking control of their finances.

SECURE YOUR COPY TODAY

and get a complimentary budget tracker template (worth $29)

For anyone looking to get certainty

in achieving your financial goals

Value-Packed Book Covering 8 Essential Areas

About Money Management Allowing You to

TAKE CONTROL of Your Financial Future

Step-by-step, from budgeting for life events,

CPF optimisation, housing,

everything from insurance to investment planning.

What is "Personal Finance Unlocked" all about?

"Personal Finance Unlocked" is one of the

most comprehensive guidebook on the topic of personal finance to help working adults and fresh graduates to get an winning edge in taking control of their finances.

"Spend Less, Save More" is NOT going to solve all the issues

Most people think so long as they don't overspend, all their finances would automatically sort out on their own, but that may not necessarily be true.

Even if you are not familiar with financial concepts, you would have heard of this phrase before..

"If You Fail to Plan, You are Planning to Fail" - Benjamin Franklin

This applies to your finances as well. If you want to achieve financial independence, the best way for you to start is to draft out a financial plan for yourself.

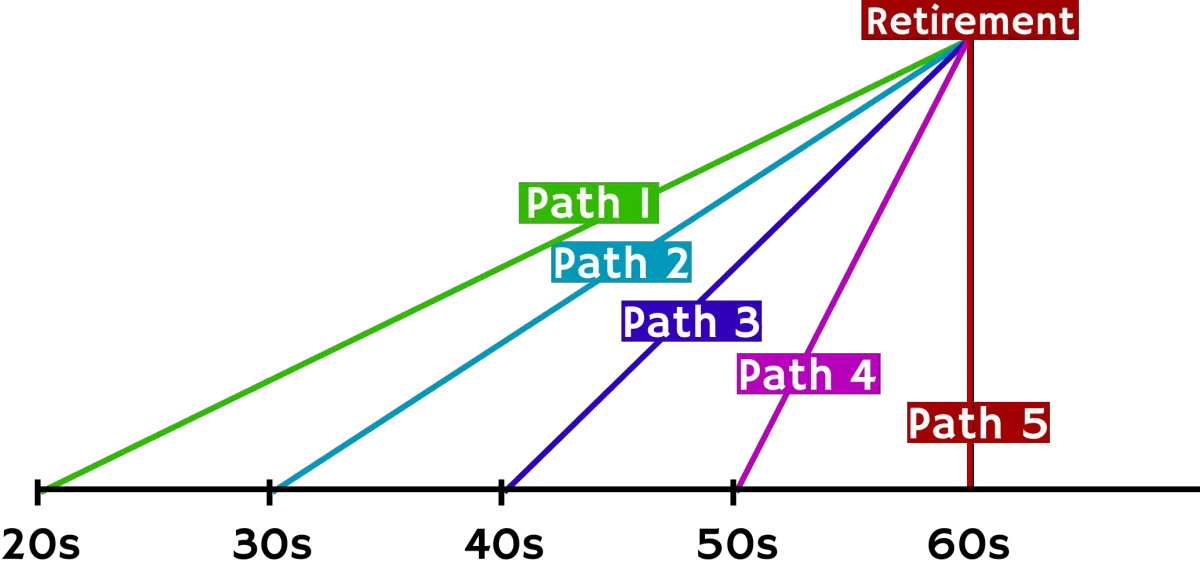

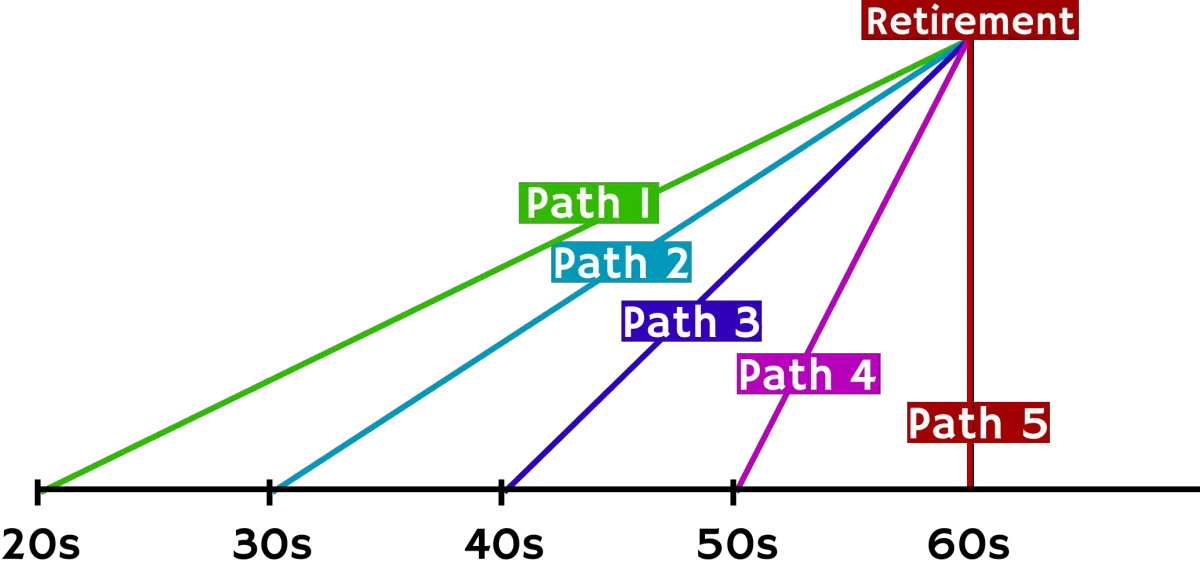

Now look at the above picture, think of working towards your destination as climbing up a mountain.

Which path would you take..?

If you are like most people, you'll probably go with Path 1, since it's a less steep route

Now let's take a look from a financial planning perspective

See the similarities? By starting your planning in your 20s and 30s, your route towards a comfortable retirement is much easier as compared to you starting in your 50s and 60s.

"Spend Less, Save More" is

NOT going to solve all the issues

Most people think so long as they don't overspend, all their finances would automatically sort out on their own, but that may not necessarily be true.

Even if you are not familiar with financial concepts, you would have heard of this phrase before..

"If You Fail to Plan,

You are Planning to Fail"

- Benjamin Franklin

This applies to your finances as well. If you want to achieve financial independence, the best way for you to start is to draft out a financial plan for yourself.

Now look at the above picture, think of working towards your destination as climbing up a mountain.

Which path would you take..?

If you are like most people, you'll probably go with Path 1, since it's a less steep route

Now let's take a look from a financial planning perspective

See the similarities? By starting your planning in your 20s and 30s, your route towards a comfortable retirement is much easier as compared to you starting in your 50s and 60s.

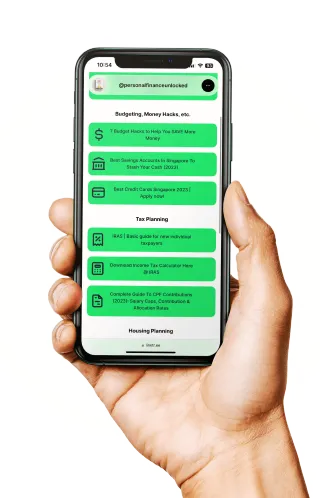

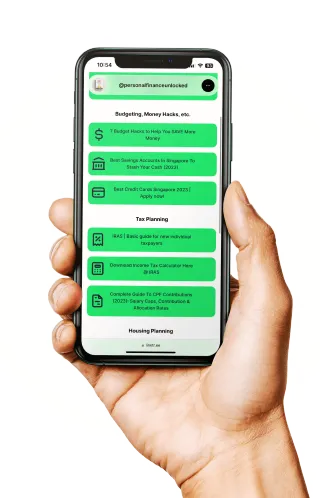

Take a look at

the articles over here

Most Singaporeans aren't the best at managing finances, and earning higher income isn't addressing the issue.

But you can prevent this from happening to yourself by equipping yourself with relevant financial concepts and knowledge

Take a look at the articles over here

Most Singaporeans aren't the best at managing finances, and earning higher income isn't addressing the issue.

But you can prevent this from happening to yourself by equipping yourself with relevant financial concepts and knowledge

"Ultimate Cheatsheet" to take control of your financial future

Ever wonder how you should go about budgeting your monthly income across short term, medium term as well as your long term goals?

Not sure how much are the financial commitments such as wedding, housing, family going to cost you?

Do you know that there are ways which you can further optimise the 37% salary that you are contributing to your CPF account to give you potentially more retirement income?

Perhaps you find the BTO process complicated, and not sure how to go about applying for a flat, which loan package you should take up.

Should you or should you not take up insurance plans, and how would they benefit you..

Everyone is talking about investment, but you don't know what to invest in..

Here's the answer to it all.

"Ultimate Cheatsheet"

to take control of your financial future

Ever wonder how you should go about budgeting your monthly income across short term, medium term as well as your long term goals?

Not sure how much are the financial commitments such as wedding, housing, family going to cost you?

Do you know that there are ways which you can further optimise the 37% salary that you are contributing to your CPF account to give you potentially more retirement income?

Perhaps you find the BTO process complicated, and not sure how to go about applying for a flat, which loan package you should take up.

Should you or should you not take up insurance plans, and how would they benefit you..

Everyone is talking about investment, but you don't know what to invest in..

Here's the answer to it all.

Here's what's covered in "Personal Finance Unlocked"

Budgeting

Budgeting framework guiding you asset allocation for short, medium and long term goals

High-interest account recommendations

Credit Card Selection Guide

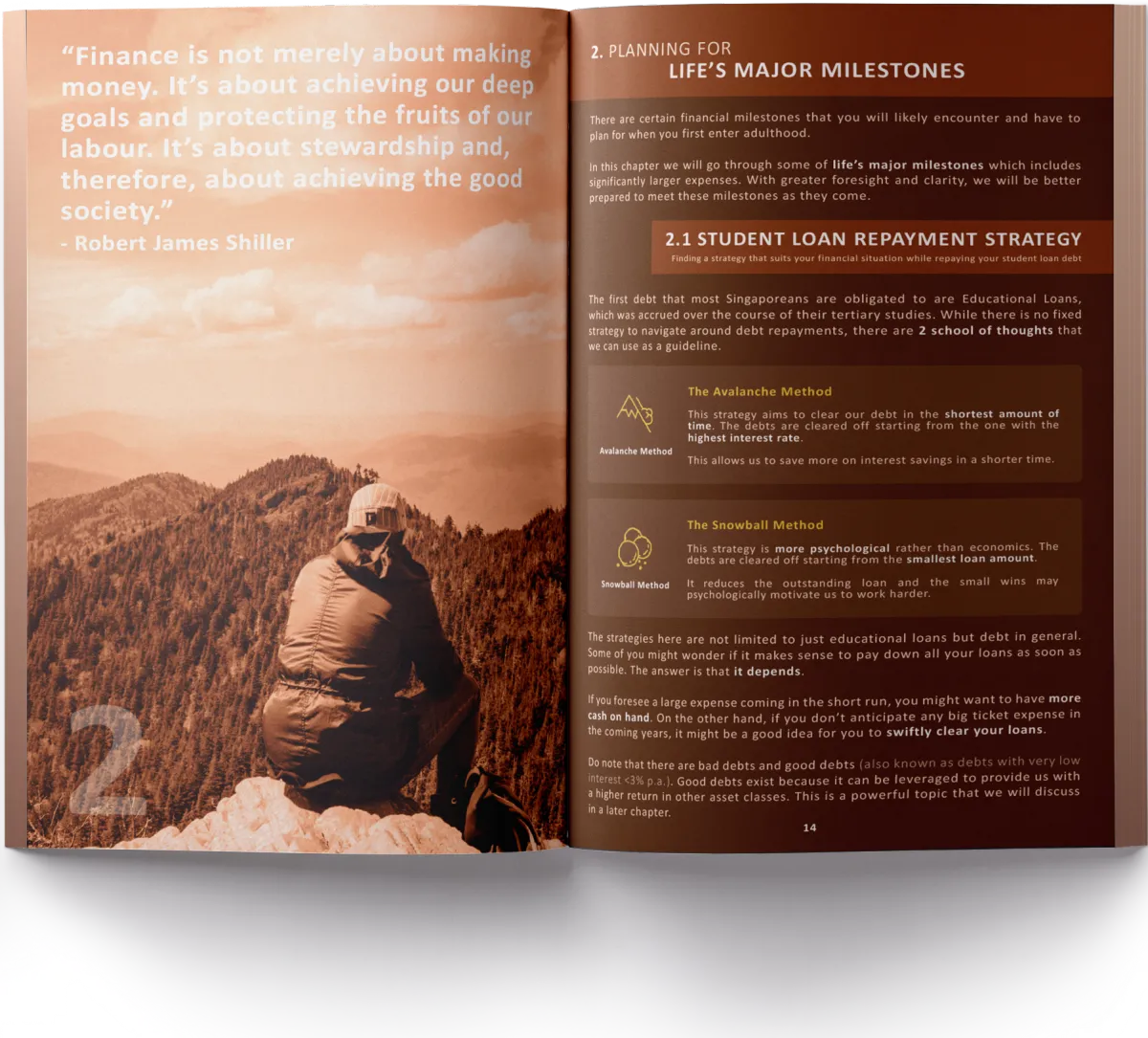

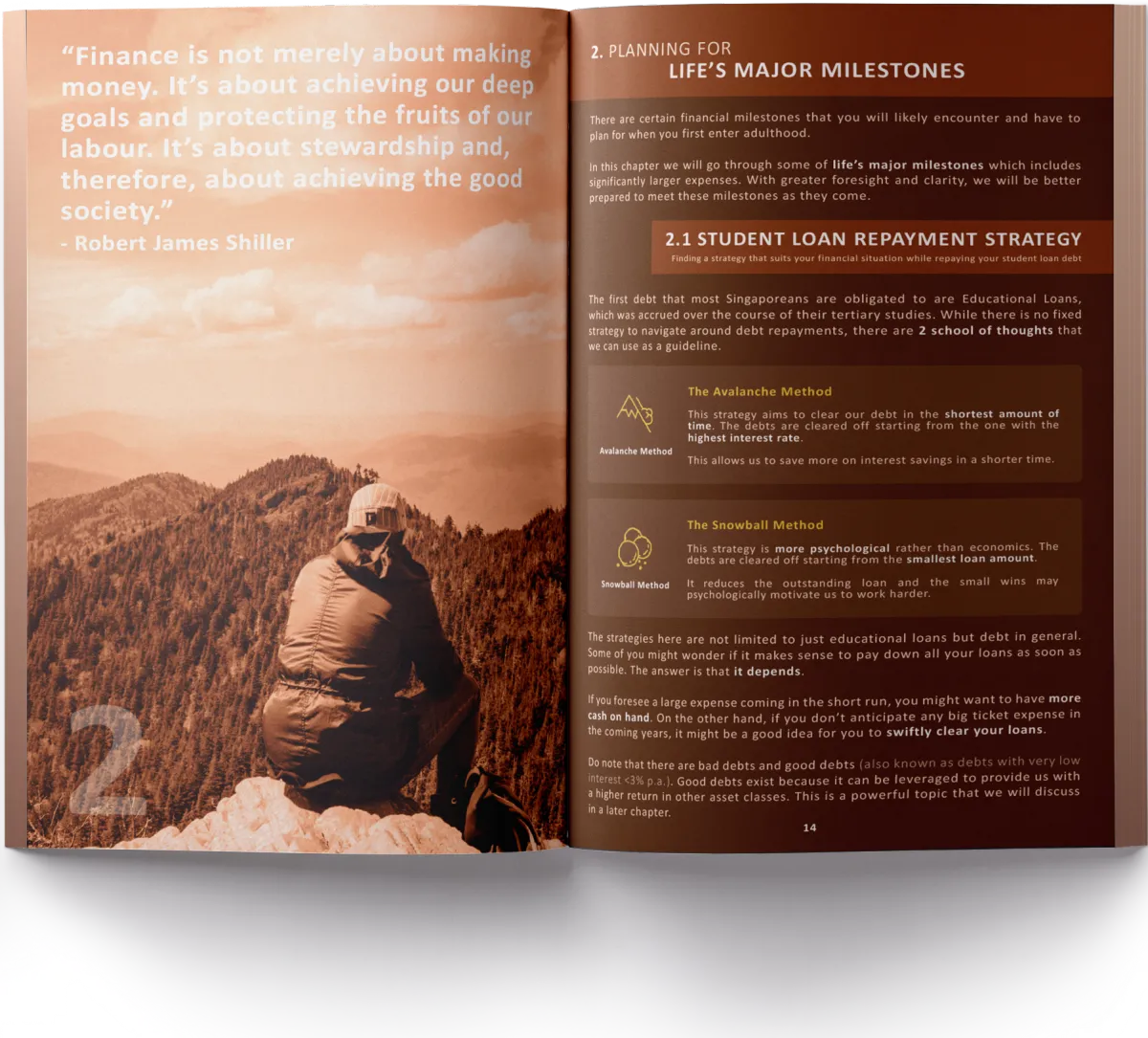

Life's Major Milestones

Financial commitments associated with wedding

Costs associated with vehicle purchase in Singapore

Cost of raising a child in Singapore

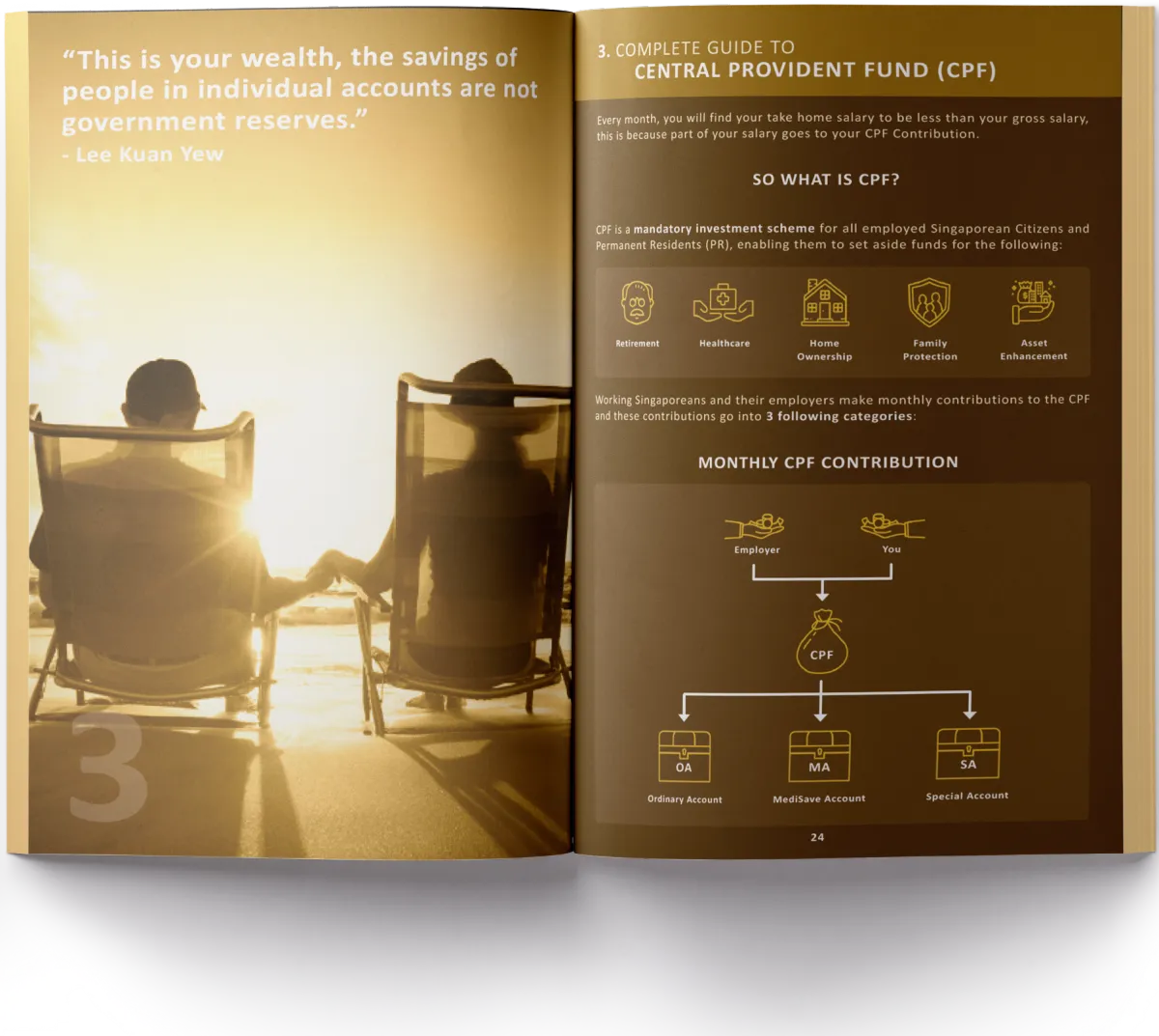

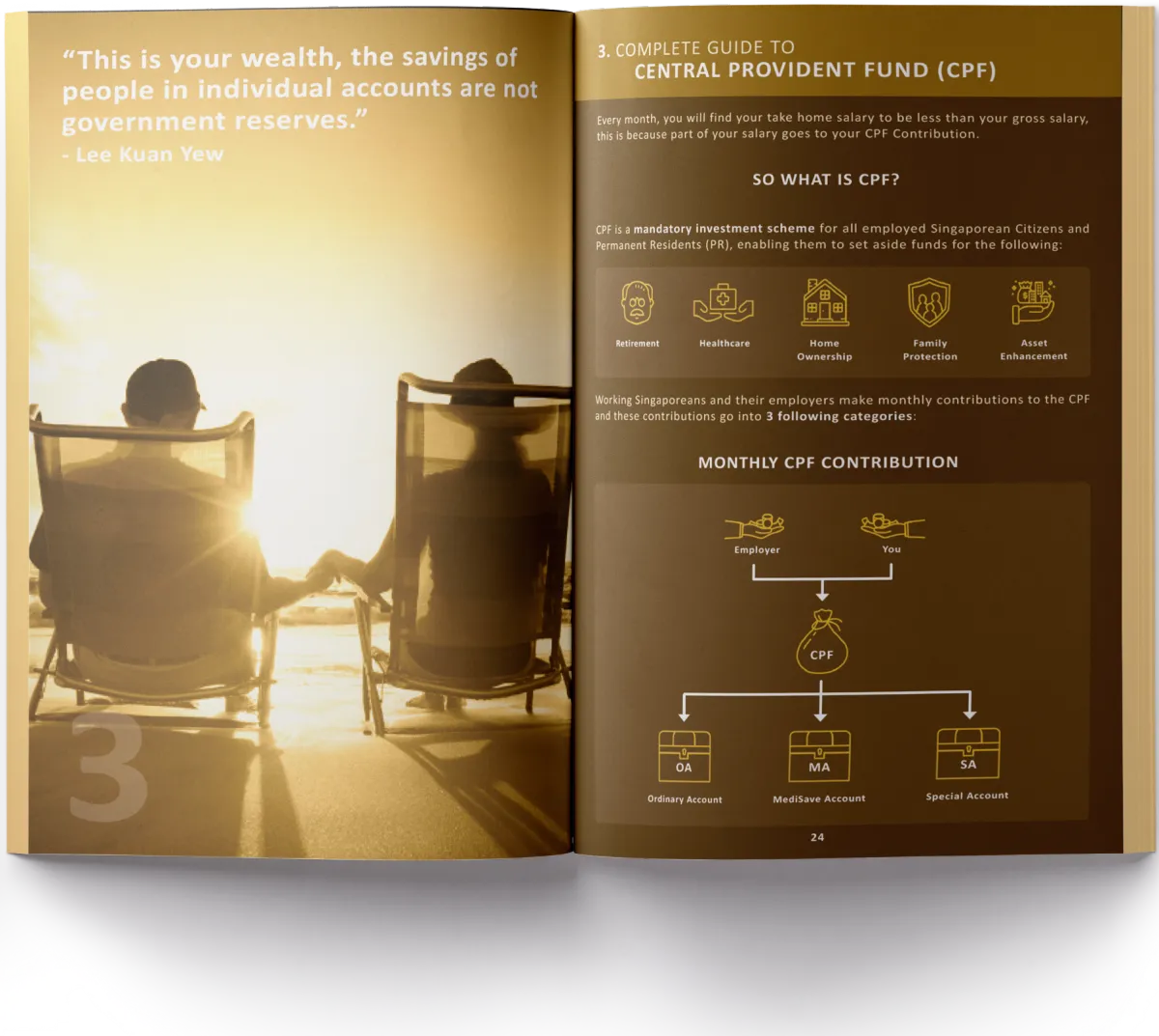

CPF Planning

Functions of your respective CPF accounts

Interest rates of respective accounts

CPF optimisation strategies

Housing Planning

BTO step-by-step process

Costs associated with vehicle purchase in Singapore

Cost of raising a child in Singapore

Insurance Planning

Introduction to different types of insurance policies

Recommended coverage you should be getting

Priority of insurance plans

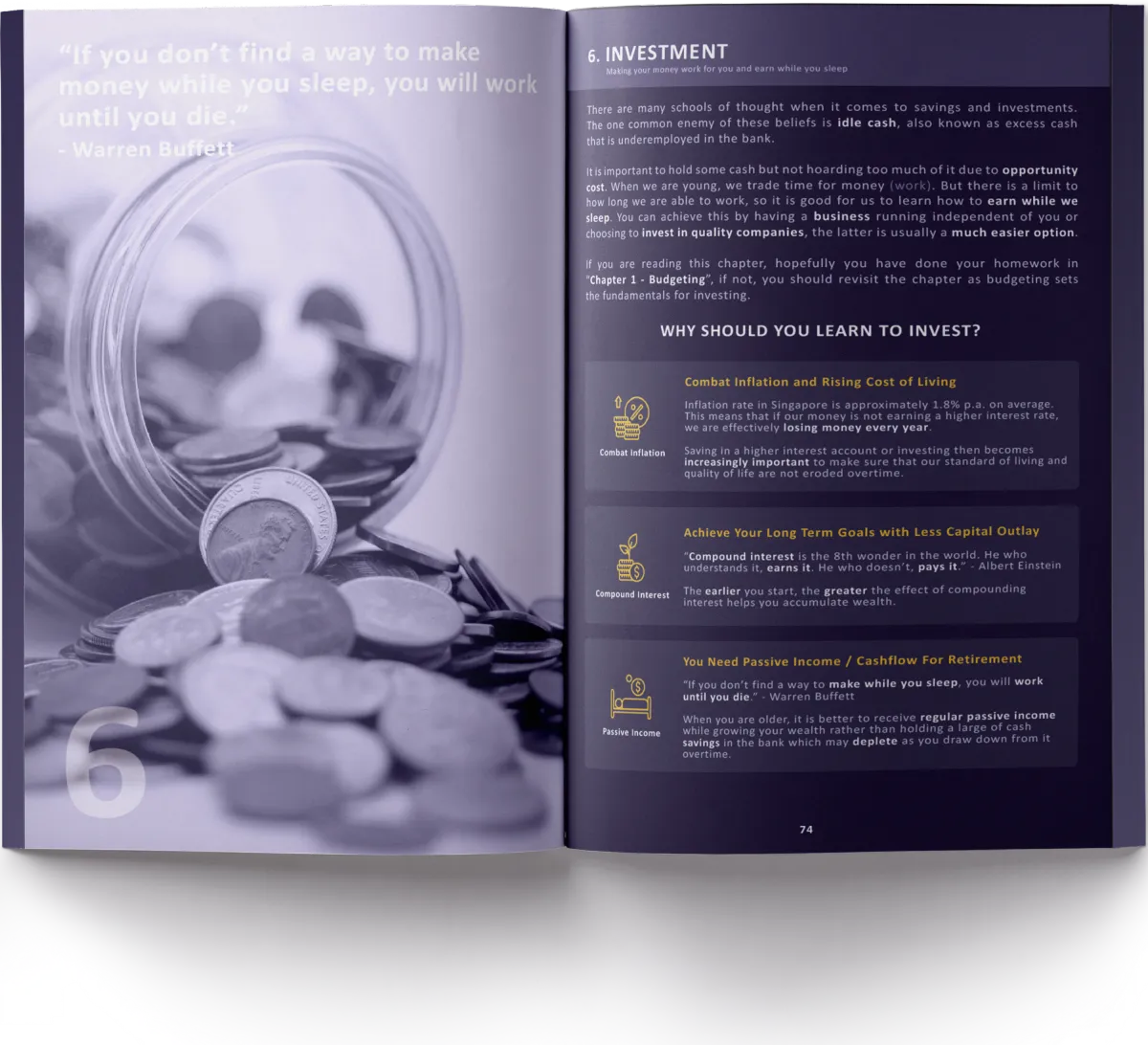

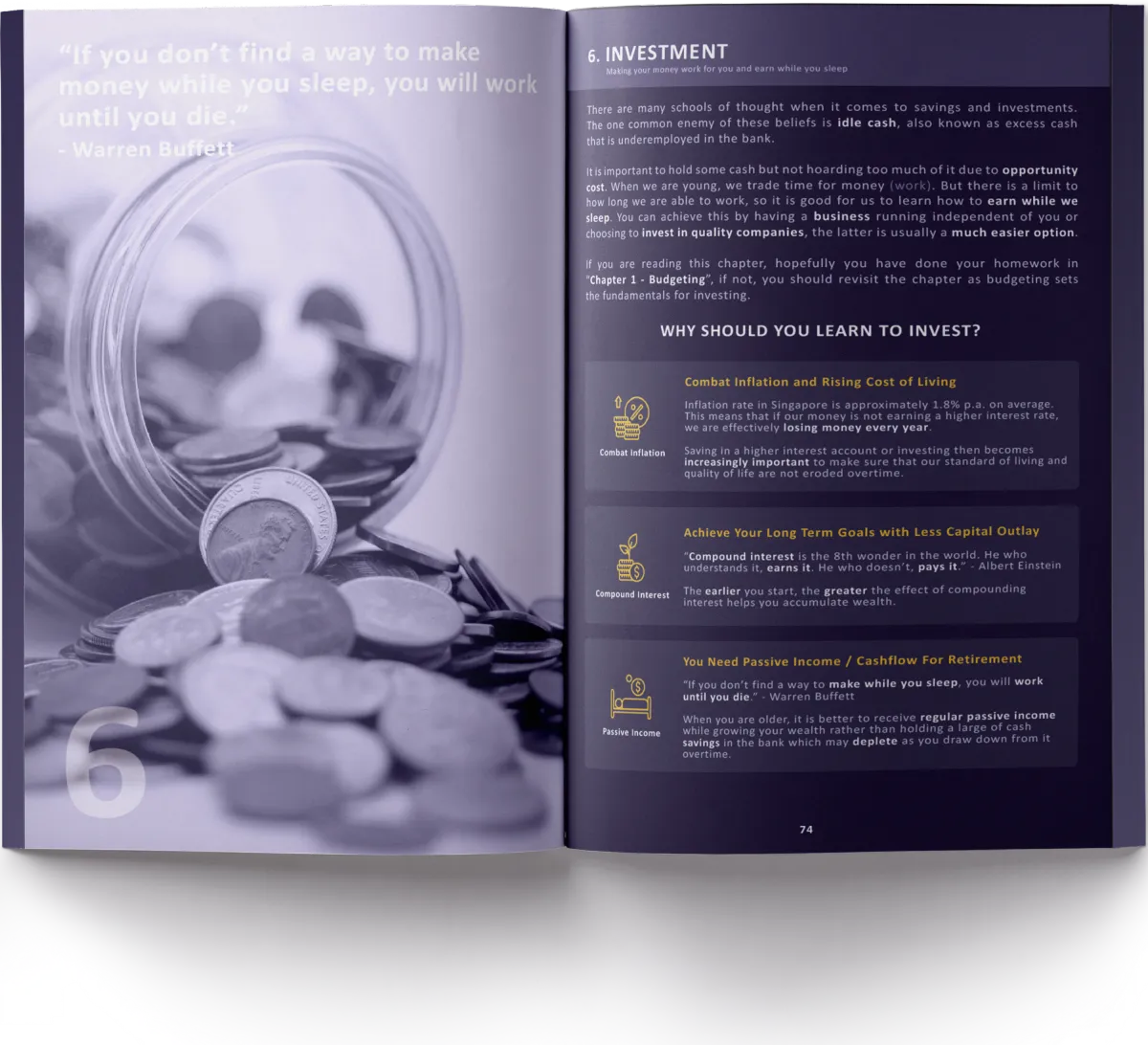

Investment Planning

Investment Objectives

Common pitfalls to avoid

Investment strategies to improve your results

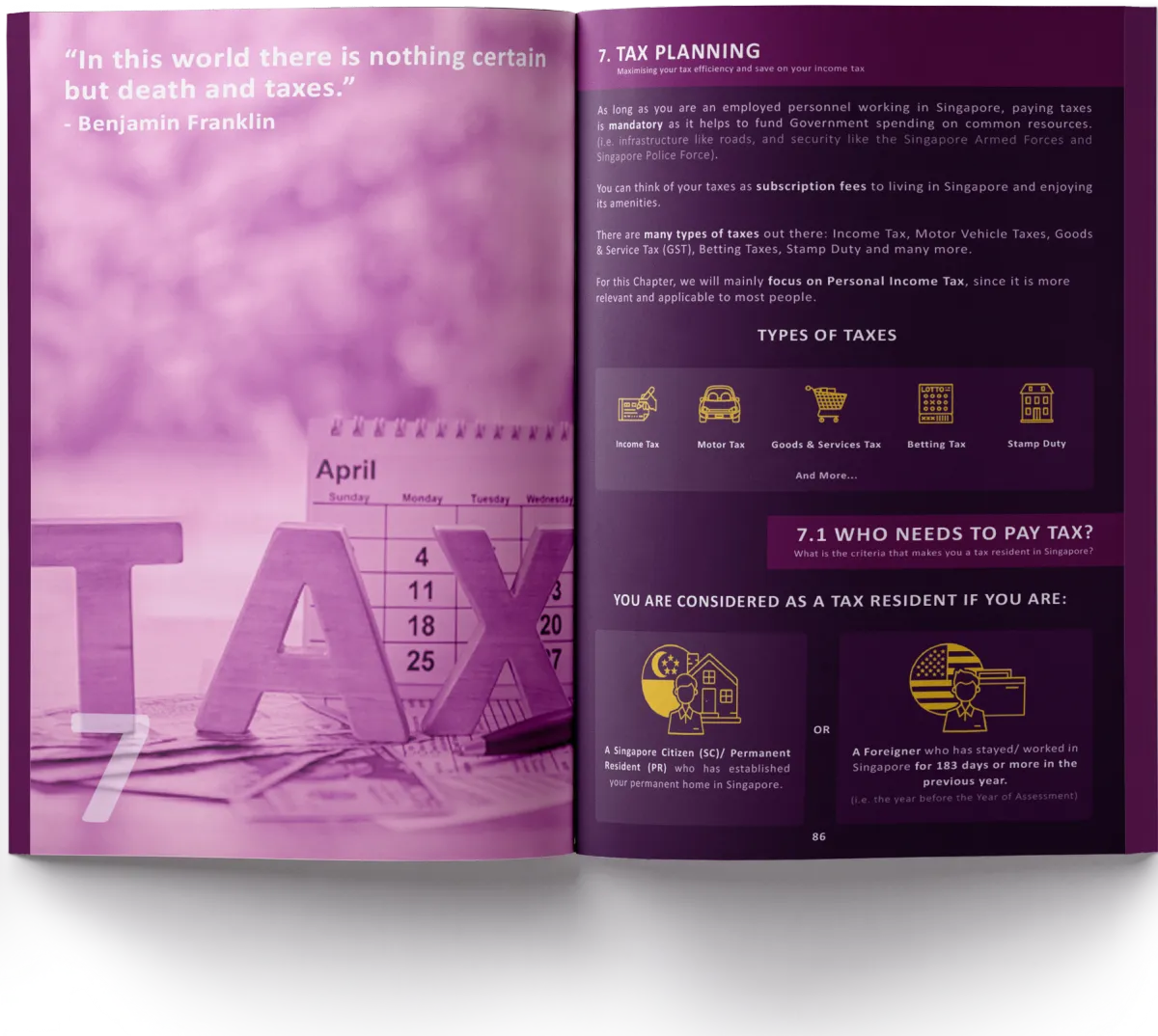

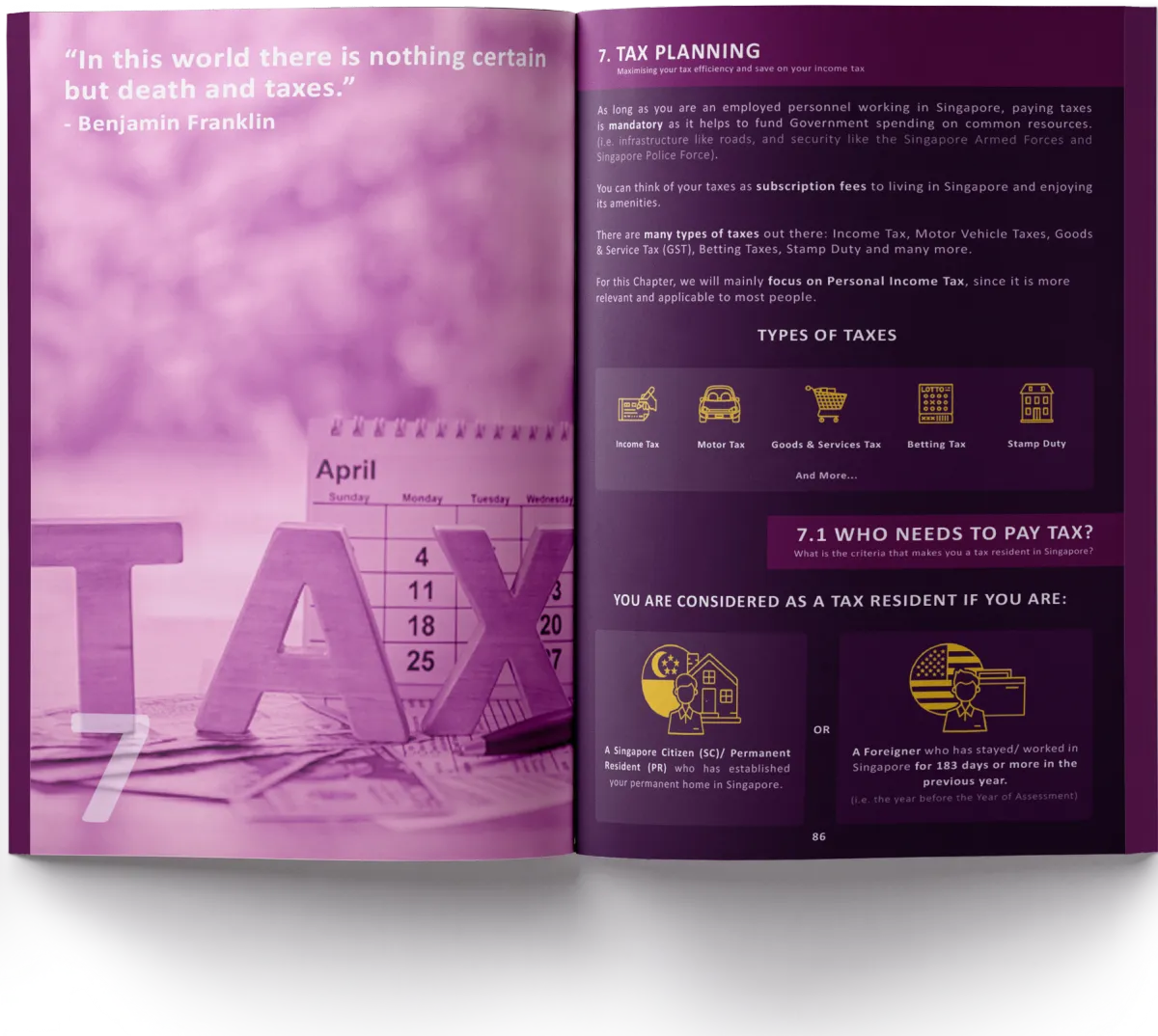

Tax Planning

Introduction to Singapore Income Tax system

Tax relief options available

Legal ways to reduce your taxable income

Estate Planning

Purposes of Estate Planning

Estate Planning Tools commonly used in estate planning and their functions

Here's what's covered in

"Personal Finance Unlocked"

Budgeting

Budgeting framework guiding you asset allocation for short, medium and long term goals

High-interest account recommendations

Credit Card Selection Guide

Life's Major Milestones

Financial commitments associated with wedding

Costs associated with vehicle purchase in Singapore

Cost of raising a child in Singapore

CPF Planning

Functions of your respective CPF accounts

Interest rates of respective accounts

CPF optimisation strategies

Housing Planning

BTO step-by-step process

Costs associated with vehicle purchase in Singapore

Cost of raising a child in Singapore

Insurance Planning

Introduction to different types of insurance policies

Recommended coverage you should be getting

Priority of insurance plans

Investment Planning

Investment Objectives

Common pitfalls to avoid

Investment strategies to improve your results

Tax Planning

Introduction to Singapore Income Tax system

Tax relief options available

Legal ways to reduce your taxable income

Estate Planning

Purposes of Estate Planning

Estate Planning Tools commonly used in estate planning and their functions

$176 OF VALUE-PACKED CONTENT

(Get ALL BONUSES FOR FREE when you get "Personal Finance Unlocked")

Personal Finance Unlocked Book

Bonus #1

Ultimate Guidebook to your Personal Finance Journey

($59 $20)

8 Chapters on financial planning covering everything from top to bottom guiding you to take control of your financial future.

Personal Finance Unlocked

Budget Tracker Template

($29 FREE)

Simple-to-use budget tracker template with step-by-step instructions allowing you to keep track of your finances

Bonus #2

Bonus #3

Exclusive Resource Hub

($29 FREE)

Latest information on best bank accounts, credit cards, housing guides, changes that are relevant to your finances, constantly updated by the team.

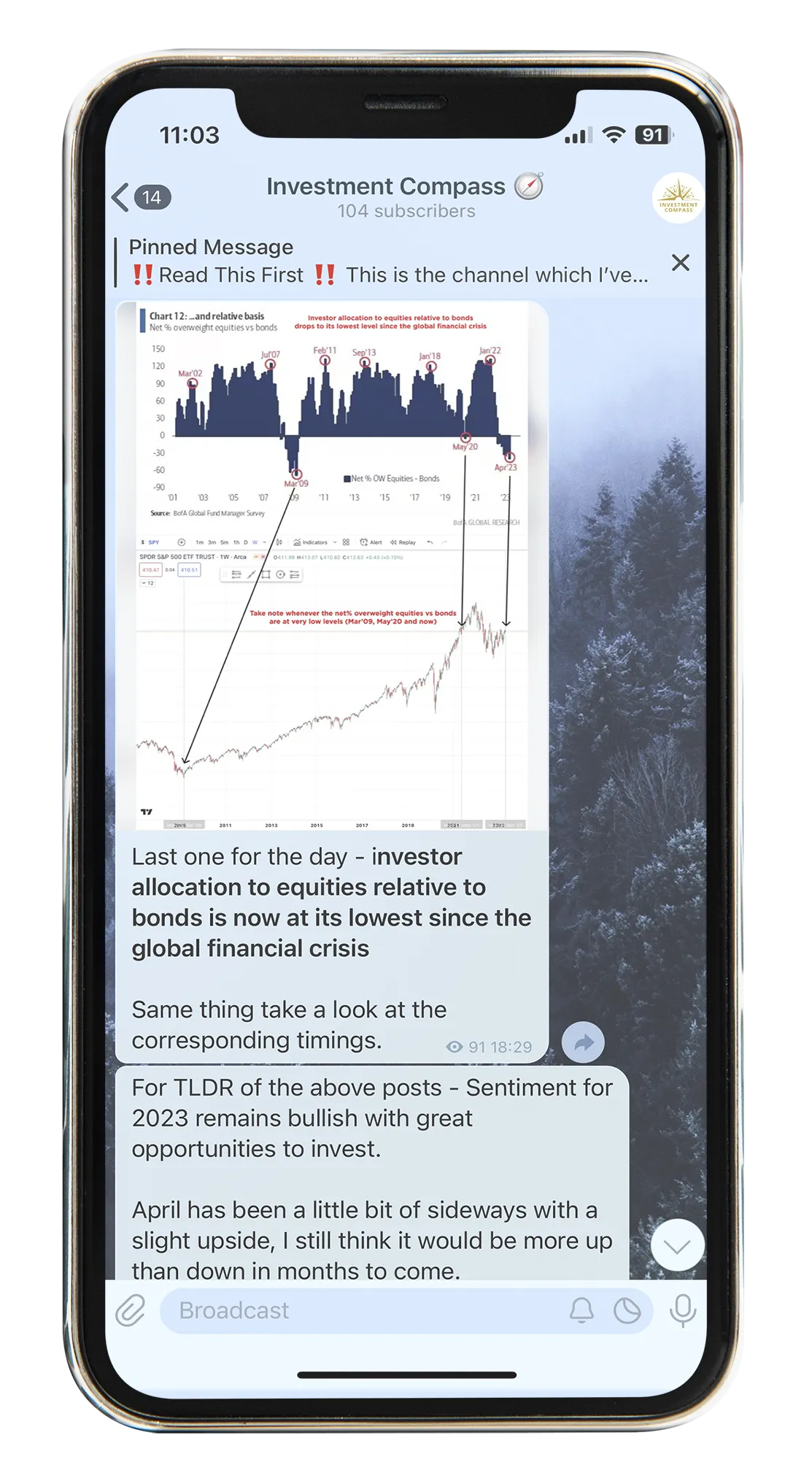

Exclusive Access to Investment Community

($59 FREE)

Get the latest market updates and investment insights by the PFU team to guide you in your investment journey.

$176 OF VALUE-PACKED CONTENT

Get ALL BONUSES FOR FREE

when you get "Personal Finance Unlocked"

Personal Finance Unlocked Book

Ultimate Guidebook to your

Personal Finance Journey

($59 $20)

8 Chapters on financial planning covering everything from top to bottom guiding you to take control of your financial future.

Bonus #1

Personal Finance Unlocked

Budget Tracker Template

($29 FREE)

Simple-to-use budget tracker template with

step-by-step instructions allowing you

to keep track of your finances

Bonus #2

Exclusive Resource Hub

($29 FREE)

Latest information on best bank accounts, credit cards, housing guides, changes that are relevant to your finances, constantly updated by the team.

Bonus #3

Exclusive Access to

Investment Telegram Channel

($59 FREE)

Get the latest market updates and investment insights by the PFU team to guide you in your investment journey.

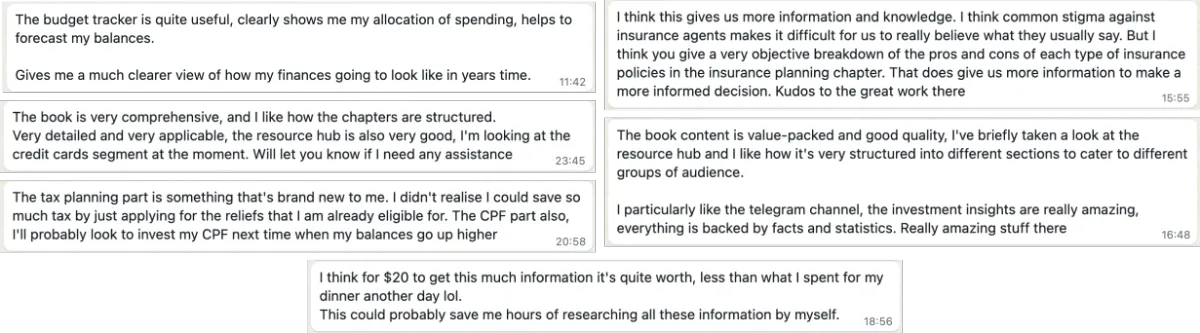

What are others saying about "Personal Finance Unlocked"?

What are others saying about

"Personal Finance Unlocked"?

Frequently Asked Questions

Who should get this book?

"Personal Finance Unlocked" is for anyone looking for a better way to manage their finances.

As long as you're looking to get better at money management, growing your wealth, this is for you.

This book literally will give you all the information you need from A to Z, and even if you have any questions, we have a strong support team to guide you along as well.

How is this different than all the other stuff out there?

"Personal Finance Unlocked" is written in a very easy-to-understand style, even for people who have no prior experience with personal finance. We use clear and concise language to explain complex financial concepts, and use plenty of real-world examples to illustrate their points.

We also make sure the content is very comprehensive, covering a wide range of personal finance topics, from budgeting and saving to investing and retirement planning. This makes it a valuable resource for anyone who wants to learn more about personal finance, regardless of their level of knowledge or experience.Third, the book is very practical.

Some of the key differences between "Personal Finance Unlocked" and other personal finance books:

1. Focus on the big picture: Other personal finance books often get bogged down in the details of budgeting, saving, and investing. "Personal Finance Unlocked" takes a step back and focuses on the big picture, helping readers to understand the fundamental principles of personal finance.

2. Real-world examples: Other personal finance books often use hypothetical examples to illustrate their points. "Personal Finance Unlocked" uses real-world examples from the authors' own lives and from the lives of their clients. This makes the book more relatable and helps readers to see how the principles of personal finance can be applied to their own lives.

3. Actionable advice: Other personal finance books often provide general advice that is difficult to implement. "Personal Finance Unlocked" provides specific, actionable advice that readers can use to improve their financial situation.

What is the Budget Tracker Template all about?

The budget tracker template is a simplified tool of what we use to plan for our clients for their finances.

Without going to a financial adviser, you will be able to calculate for yourself to assess your financial health.

The budget tracker would also help you do a forecast of your finances ahead, along with our net worth calculator and financial ratios automatically calculated for you. Helping you to get a clear picture of how your finances look like.

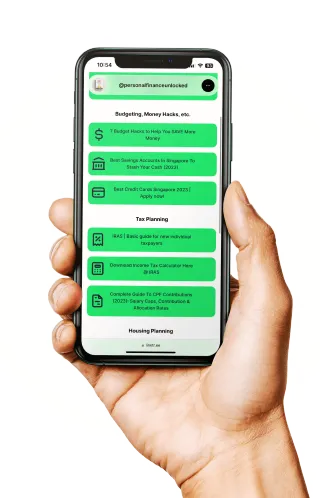

How is the resource hub going to be useful?

The resource hub contains the latest financial news and articles that are related to our day to day activities.

Some examples would be the latest information on bank account interest rates, credit card offers.

For those who are looking at housing planning, we have the latest BTO information as well as comparison between bank and HDB loans for you to make a more informed decision.

Other useful information such as tax planning and CPF information are also included in the resource hub.

The resource hub is regularly updated to give you guys the most updated informaiton.

What is the Telegram channel all about?

"Investment Compass" is the Telegram channel open to all Personal Finance Unlocked readers. On top of generic financial planning concepts which the book will cover. This Telegram channel focuses specifically on investment related information for those who are looking to get themselves more familiarised with investment.

This is where our team will be posting market updates and investment analysis, and occasionally our own stock/ ETF purchases for education purposes.

More about the authors and the team behind Personal Finance Unlocked

"Personal Finance Unlocked" is a year-long project lead by Hsin An and his co-author. Hsin An has been in the financial services industry for more than 5 years and have spoken to more than 1,000 young adults till date.

After meeting these people, he recognised the importance of equipping people with financial planning knowledge so that they can make informed decisions, and not just listening to any financial advice out there.

Beyond just the book itself, Hsin An is also working with his colleagues to manage the resource hub and telegram channel to provide more value to the community of readers.

Read more about Hsin An here

Frequently Asked Questions

Who should get this book?

"Personal Finance Unlocked" is for anyone looking for a better way to manage their finances.

As long as you're looking to get better at money management, growing your wealth, this is for you.

This book literally will give you all the information you need from A to Z, and even if you have any questions, we have a strong support team to guide you along as well.

How is this different than all the other stuff out there?

"Personal Finance Unlocked" is written in a very easy-to-understand style, even for people who have no prior experience with personal finance. We use clear and concise language to explain complex financial concepts, and use plenty of real-world examples to illustrate their points.

We also make sure the content is very comprehensive, covering a wide range of personal finance topics, from budgeting and saving to investing and retirement planning. This makes it a valuable resource for anyone who wants to learn more about personal finance, regardless of their level of knowledge or experience.Third, the book is very practical.

Some of the key differences between "Personal Finance Unlocked" and other personal finance books:

1. Focus on the big picture: Other personal finance books often get bogged down in the details of budgeting, saving, and investing. "Personal Finance Unlocked" takes a step back and focuses on the big picture, helping readers to understand the fundamental principles of personal finance.

2. Real-world examples: Other personal finance books often use hypothetical examples to illustrate their points. "Personal Finance Unlocked" uses real-world examples from the authors' own lives and from the lives of their clients. This makes the book more relatable and helps readers to see how the principles of personal finance can be applied to their own lives.

3. Actionable advice: Other personal finance books often provide general advice that is difficult to implement. "Personal Finance Unlocked" provides specific, actionable advice that readers can use to improve their financial situation.

What is the Budget Tracker Template all about?

The budget tracker template is a simplified tool of what we use to plan for our clients for their finances.

Without going to a financial adviser, you will be able to calculate for yourself to assess your financial health.

The budget tracker would also help you do a forecast of your finances ahead, along with our net worth calculator and financial ratios automatically calculated for you. Helping you to get a clear picture of how your finances look like.

How is the resource hub going to be useful?

The resource hub contains the latest financial news and articles that are related to our day to day activities.

Some examples would be the latest information on bank account interest rates, credit card offers.

For those who are looking at housing planning, we have the latest BTO information as well as comparison between bank and HDB loans for you to make a more informed decision.

Other useful information such as tax planning and CPF information are also included in the resource hub.

The resource hub is regularly updated to give you guys the most updated informaiton.

What is the Telegram channel all about?

"Investment Compass" is the Telegram channel open to all Personal Finance Unlocked readers. On top of generic financial planning concepts which the book will cover. This Telegram channel focuses specifically on investment related information for those who are looking to get themselves more familiarised with investment.

This is where our team will be posting market updates and investment analysis, and occasionally our own stock/ ETF purchases for education purposes.

More about the authors and the team behind Personal Finance Unlocked

"Personal Finance Unlocked" is a year-long project lead by Hsin An and his co-author. Hsin An has been in the financial services industry for more than 5 years and have spoken to more than 1,000 young adults till date.

After meeting these people, he recognised the importance of equipping people with financial planning knowledge so that they can make informed decisions, and not just listening to any financial advice out there.

Beyond just the book itself, Hsin An is also working with his colleagues to manage the resource hub and telegram channel to provide more value to the community of readers.

Read more about Hsin An here